Who would have thought that monthly rent payment can be rewarding? With a number of brands launching app services to facilitate rent payment via Credit Cards, a lot of marketing techniques are being used, to attract users to their platforms. This includes not just the regular credit card reward points but additional offers that can sweeten the deal further.

Here is how users can take benefit of these cashbacks and make the most of their time and money:

Earning reward points and redeeming it

Currently, the market is flooded with different credit cards that are customised to suit your needs. This includes ones that offer additional reward points on online spends to others that offer lump-sum points for maximum monthly spends. These reward points can be easily redeemed for cashbacks or online vouchers for online shopping, flight tickets or discount codes.

While most of the credit cards are devoid of annual membership charges or charges that can be waived off under certain circumstances, credit card usage at some platforms can sometimes attract a minimal service fee. Therefore, to offset this additional charge, it is often advised to use credit cards where additional rewards points can be earned to be redeemed as a cashback. This includes online rent payment through credit card, where the charges are minimal but the reward points gained can be doubled or tripled, depending upon your credit card provider.

Additional offers and deals

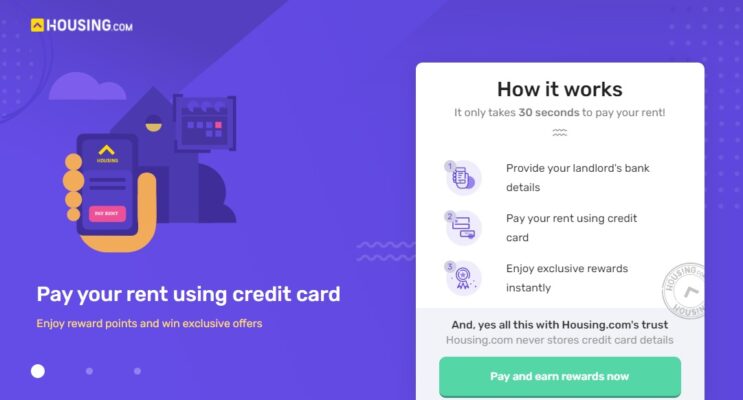

Apart from the reward points, one stands to gain other benefits from using a credit card to pay rent online. For example, Housing.com Pay Rent feature offers added rewards from top brands on every payment made on the platform. While the Pay Rent platform also allows rent payment through debit cards and wallets, credit cards seem to be the most rewarding if you are planning to pay timely rent without putting your cash flows under stress.

Moreover, payment of rent via credit card also offers non-monetary benefits, which can later help you if you apply for a loan. By utilising your credit line and making timely payments on your credit card bill, you are creating a strong credit history for yourself, which is most important when you apply for a home loan, car loan or personal loan. Better the credit history, greater are the chances of getting an attractive interest rate from the bank. The credit history is also important, if you want to upgrade your credit card or credit limit.

However, for a strong credit history, it is important that you make credit card payments in full and not just the minimum amount. If you tend to pay only the minimum amount, you will have to pay additional interest on the remaining balance. Moreover, if you fail to pay the minimum amount, your bank may subject you to additional penalty. In extreme cases, your profile may get reported to the credit bureaus.

FAQs

Can I avail cashback on credit card rent payment?

Yes, you can avail of a number of benefits on credit card rent payment, including cashbacks on redemption of credit card reward points.

Can I use Housing’s Pay Rent feature for debit card rent payment?

Yes, you can use the Pay Rent feature for debit cards and wallets.

How many reward points can I earn on my credit card?

It depends on your credit card service provider.

Surbhi is an experienced content marketing expert for over nine years now and has contributed articles and research insights for top real estate portals. She is a journalism graduate and has keen interest in politics, urban development and infrastructure studies. Surbhi is a bookworm and delves into historical fiction and inspiring biographies when she is not sleeping.

Facebook: https://www.facebook.com/surbhi.gupta2406/

Twitter: https://twitter.com/surbhi2406

Linkedin: https://www.linkedin.com/in/surbhi-gupta-82159b63/

Quora: https://www.quora.com/profile/Surbhi-Gupta-17

about.me: about.me/surbhi.gupta/