If you stay in a rented house, you may understand the challenges of balancing between payday and rent day. For difficult times like now, when the Coronavirus pandemic is crippling the economy and people are being laid off, paying rent on time may be a big financial challenge for some of us. Even though landlords have been asked to provide grace period to the tenants for paying rent for the next three months, you may not expect all landlords to be generous. In such scenarios, paying rent using your credit card could be a great option.

What is Housing.com’s Pay Rent platform?

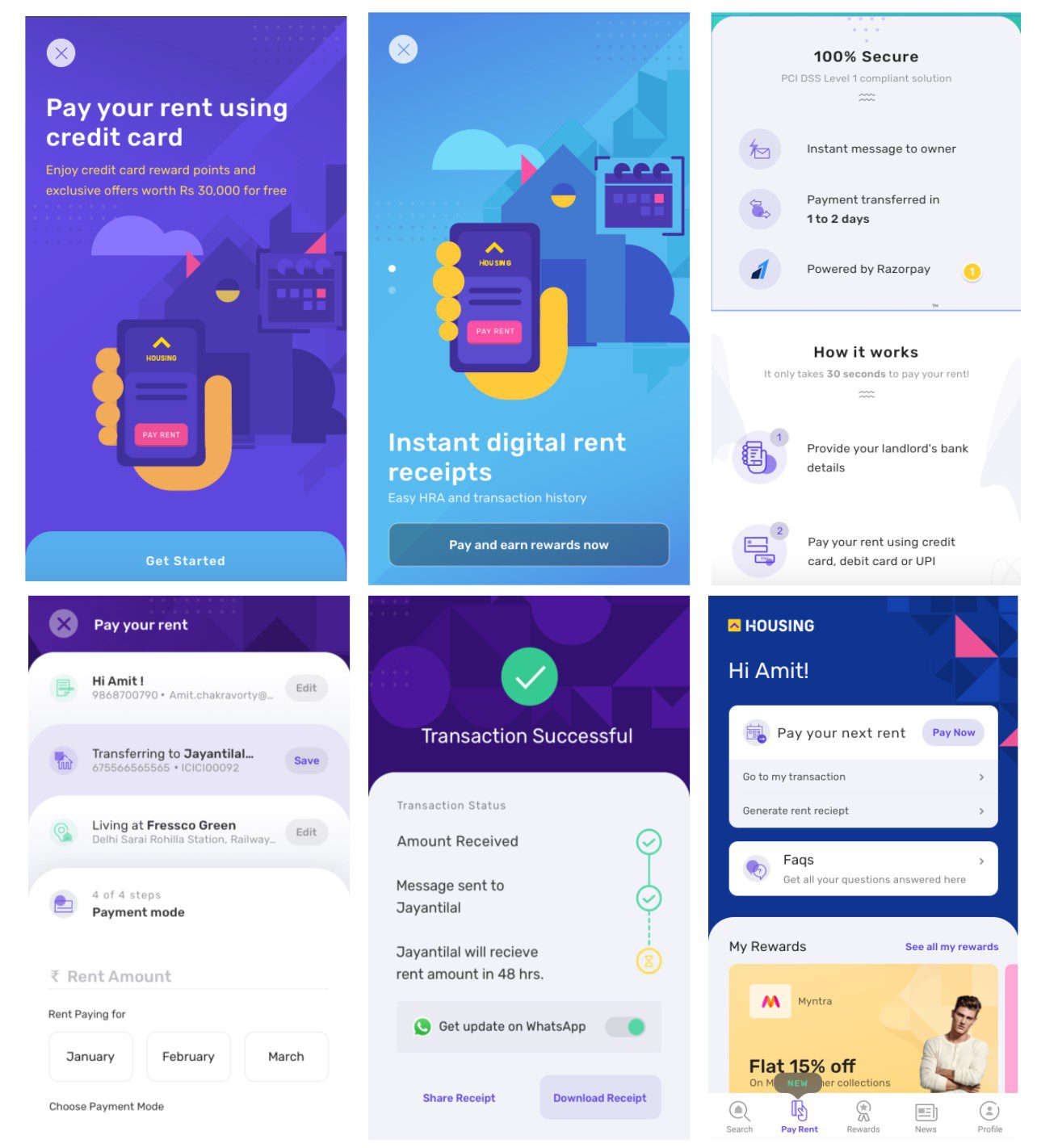

Keeping such situations in mind and to provide a hassle-free payment system for all rent-payers, Housing.com is coming up with the Pay Rent platform for facilitating monthly rental payment through credit cards. The platform will provide seamless experience to users and will directly transfer the amount to the landlord’s bank account in moments.

Here’s how to use the Housing Pay Rent platform:

Step 1: Download the app from Google Play Store

Step 2: Choose Pay Your Rent option

Step 3: Enter your full name, mobile number and your email Id.

Step 4: Mention the complete bank details of your landlord, along with the IFSC code for funds transfer.

Step 5: Choose the payment mode and make the transfer.

Step 6: Generate instant rent receipt for HRA and transaction history.

Benefits of using Housing.com Pay Rent platform

* Exclusive rewards and coupons from prominent brands

For every penny you pay using Housing.com Pay Rent platform, you get up to 3% reward points from your credit card provider for spending your credit limit. These rewards can be redeemed anytime through your lender’s portal without any limitation. You can also take cashback by redeeming your rewards point.

In addition to this, we have collaborated with all your favorite brands and are onboarding many more, to make sure that your payment experience does not go unrewarded. From special discounts to exclusive offers, there will be a whole lot of things to choose from.

* Instant digital rent receipts

You can generate rent receipts instantly for your HRA submissions and transaction proofs. Since our platform offers direct bank transfer and is not a wallet-system, you do not have to keep score of wallet recharge, etc.

* 100% secure transaction

We have collaborated with the most secure payment gateway to facilitate 100% safe and secure transaction for you. Our platform also supports UPI and debit card payment, in case you do not want to use your credit card balance for rent payment.

Why should you use credit card for paying rent?

1. Get rewards for using credit card limit

Almost all credit card providers offer reward points for using the credit limit for online payment and transactions. While direct bank transfer does not brings you any benefit, if you use your credit card for rental payment, you can earn reward points on your credit card, which you can accumulate and redeem for buying flight tickets, restaurant vouchers or for online shopping, without any extra cost. That means your usual monthly payment can add extra benefit in your kitty, without any additional charge.

2. Keep your liquidity intact

You do not have to spend your bank account balance, as you can pay rent via credit card. If you have unused credit card limit available, you can use that to transfer the amount to your landlord’s bank account, using Housing.com Pay Rent option. The online payment made will be shown in your credit card bill statement, which you can pay before the due date to avoid the finance charges. Suppose, your salary day is 7th while your landlords prefer rent on the 1st of every month and your credit card bill is generated on the 15th with a due date of the 3rd of the next month. You can transfer the rent on time and pay the credit card bill before the due date, with your account balance. This way you can defer the cycle by almost a month.

3. Improve your credit score

Using your credit card limit and timely repayment also helps in boosting your credit score and creating a healthy credit history. This will help you in enhancing your loan eligibility. Apart from this, your credit utilisation health is also important for improving your credit score. Suppose, your credit limit is Rs 1 lakh and more than 50% of your limit remains unutilised for a long time, your credit score might slip a few points, because of this. If you are using your credit limit to pay big amounts and if you are repaying the debt on time, you are considered as a disciplined borrower.

4. Opt for EMI moratorium

If there has been a salary delay or deduction at your workplace, due to the Coronavirus pandemic and your landlord is not agreeing to defer your rent, you can simply use your credit card to transfer the amount and opt for the EMI moratorium, to postpone your credit card bill payment for three months. As recently announced by the RBI, all banks have to extend the EMI holiday for retail loans, including credit card payments, as well. However, do not forget that you have to pay additional finance charges to the bank, for deferring the card payment.

See also: Read about UCO Bank IFSC code

Surbhi is an experienced content marketing expert for over nine years now and has contributed articles and research insights for top real estate portals. She is a journalism graduate and has keen interest in politics, urban development and infrastructure studies. Surbhi is a bookworm and delves into historical fiction and inspiring biographies when she is not sleeping.

Facebook: https://www.facebook.com/surbhi.gupta2406/

Twitter: https://twitter.com/surbhi2406

Linkedin: https://www.linkedin.com/in/surbhi-gupta-82159b63/

Quora: https://www.quora.com/profile/Surbhi-Gupta-17

about.me: about.me/surbhi.gupta/