April 5, 2024: The Reserve Bank of India (RBI) on April 5, 2024, left the repo rate unchanged at 6.50%. This is the 7th time in a row the banking regular has maintained a status quo on its key policy rate. Cumulatively, the RBI hiked the repo rate by 250 basis points in FY23.

How changes in repo rate impact homebuyers?

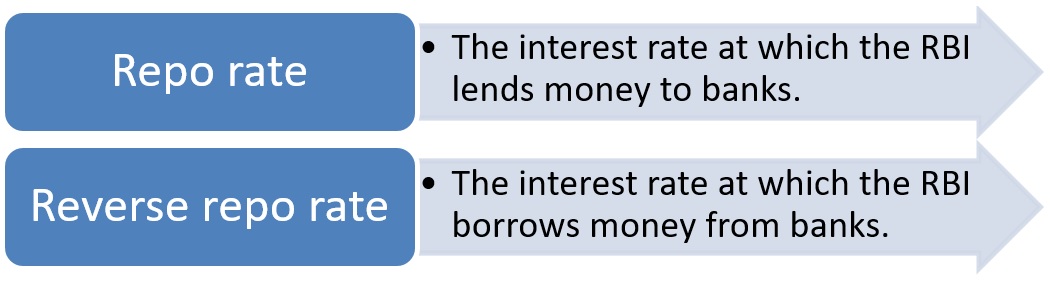

Every time the RBI makes a change in the repo rate, homebuyers are told that the cost of borrowing will become higher/lower because of the upwards/downward change in the lending rate. As the repo rate has such a significant bearing on your financials, it is important to know everything about it, and how it impacts your home loan liability. It is also essential to know how the reverse repo rate works to have a better clarity on the working of your home loans.

See also: All about RBI home loan interest rate

What is repo rate?

As is obvious, banks need funds for lending purposes. Apart from taking deposits from the general public, they also have the option to borrow from the central banks. Just like borrowers have to pay a certain interest to avail of credit from banks, financial institutions also have to pay interest for the money they borrow from the central bank. This interest is known as the repo rate. The term ‘repo’ is short for repurchasing option or repurchase agreement. Under the arrangement, scheduled commercial banks provide securities such as treasury bills or gold to the RBI for availing of overnight credit in case of liquidity shortfall.

See also: Know about SBI CIBIL score

Repo and reverse repo rate in 2024

| Repo rate | Reverse repo rate |

| 6.50% | 3.35% |

See also: Best banks to get home loans in 2024

Aside from helping banks with credit availability, the repo rate is an effective tool for the banking regulator to control inflation. In case of high inflation, the RBI increases the repo rate to discourage banks from borrowing. This eventually reduces the liquidity in the economy, subsequently taming the high inflation. A reverse technique is put in place in case of falling inflation. In this scenario, the repo rate is reduced in a move to prompt banks to borrow more credit, which ultimately increases the supply in the market, triggering fresh investment activity.

Note here that the credit thus extended by the RBI to the banks is provided only for overnight, and the banks buy back their securities deposited with the banking regulator at a predetermined price.

See also: What is legal and technical verification of property in home loan?

What is reverse repo rate?

Reverse repo rate is the interest which banks charge from the RBI to lend credit to the banking regulator. Reverse repo rate is another tool used by the RBI to maintain desired inflation levels by way of absorbing liquidity from the system. By increasing interest, the banking regulator encourages banks to lend money to it, which results in depletion of excess liquidity from the system. Banks are thus not left with a lot of credit to lend.

See also: All about Capital adequacy ratio

Difference in repo rate-reverse repo rate

| Repo rate | Reverse repo rate |

| The interest RBI charges to lend credit. | The interest RBI pays on borrowings. |

| Always higher than reverse repo rate. | Always lower than repo rate. |

| A tool to control inflation. | A tool to maintain cash flow. |

| Works as per repurchase agreement. | Works as per reverse repurchase agreement. |

| Transactions take place via bonds. | Transactions happen via bonds. |

See also: RBI complaint Email ID

Key facts about repo rate in India

- The repo rate is fixed and monitored by the RBI.

- Repo rate is a tool to control inflation.

- Banks adjust savings account and fixed deposit returns, based on the repo rate.

- Before October 2004, the repo rate was known as the reverse repo rate.

What is monetary policy review?

The RBI’s six-member Monetary Policy Committee, headed by the RBI governor, meets every two months to decide its monetary policy and tweaks key interest rates, according to the prevailing economic condition. The monetary policy review also sums up the prevailing economic conditions of the country and elaborates on present and future actions that RBI plans to undertake to support the economy.

How does change in repo rate impact home loans?

When the RBI lowers the repo rate, the cost of borrowing for banks goes down. Banks are expected to pass on this benefit to the consumers eventually. Conversely, home loan interest rates go up with the RBI making an upwards tweak in its lending rate.

Incidentally, banks are quicker in passing on the increase in rates to the customers, while they are generally quite slow in reducing their lending rates. So, even though changes in the repo rate should reflect in financial institutions’ interest rates immediately, only increases see fast transmission and often the RBI has to nudge banks to pass on the benefits of reduced rates to borrowers.

With banks linking their home loan interest rates to the repo rate, since October 2019, faster transmission of policy could be expected in the future. Prior to that, banks used internal lending benchmarks like marginal cost of funds-based lending rate (MCLR), base rate and prime lending rate, to price home loans.

The MCLR, which came into effect in 2016, was an internal lending benchmark, allowing banks to ‘reset’ the loan rate, at an interval specified in the loan agreement. These rate cuts implemented by the banking regulator were not passed on to the customers by the banks as swiftly as they were expected to, while the burden was quickly passed on in case of an increase. “In case of MCLR-based loans, banks have to factor in their cost of deposit, operating cost, etc., apart from the repo rates, while calculating lending rates. Hence, MCLR-based loans are always likely to have slower transmission of policy rate changes,” says Naveen Kukreja, chief executive officer and co-founder of Paisabazaar.com.

Disappointed by the MCLR regime’s limited success, the RBI, in 2018, directed banks to switch to an external lending benchmark, so that the borrowers were better placed to reap the benefits of policy transformation. Following this, banks switched to the repo rate-linked lending regime, starting October 2019. Currently, almost all major banks in India offer home loans that are linked to the RBI’s repo rate.

Facts about repo-rate linked home loans

Buyers taking a home loan liked with the repo rates or those switching their old home loans to it, must have clarity about certain facts about these loans.

Transmission is quicker: Any changes in the repo rate are likely to be reflected in your EMI outgo much faster.

“With repo-rate linked home loans, borrowers can expect a much faster transmission on to their loan rates. Also, such loans will be more transparent, as far as the rate-setting mechanism is concerned and should add more certainty to the borrowers, in anticipating their loan interest rates,” says Kukreja.

This also means, your home loan EMI will increase as and when the banking regulator makes any change in its key lending rate. “Consequently, repo rate-linked loans can work against buyers, during the rising interest rate regime, Kukreja warns.

Also, banks will ultimately decide the additional interest they would charge, on top of the repo rate on home loans. Even though the repo rate is currently at 6.50%, the cheapest available housing loan in the market current is at 8.50%, reflecting a difference of two percentage points.

See also: What is cash reserve ratio or CRR?

Changes to repo rate since June 2000

| Rate (in %) / Date

6.50/05-04-2024 6.50/08-02-2024 6.50/06-10-2023 6.50/10-08-2023 6.50/08-06-2023 6.50/06-04-2023 6.50/08-02-2023 6.25/07-12-2022 5.90/30-09-2022 5.40/05-08-2022 4.90/08-06-2022 4.40 / 04-05-2022 4.00 / 22-05-2020 4.40 / 27-03-2020 5.15 / 06-02-2020 5.15 / 05-12-2019 5.15 / 04-10-2019 5.40 / 07-08-2019 5.75 / 06-06-2019 6.00 / 04-04-2019 6.25 / 07-02-2019 6.50 / 01-08-2018 6.25 / 06-06-2018 6.00 / 02-08-2017 6.25 / 04-10-2016 6.50 / 05-04-2016 6.75 / 29-09-2015 7.25 / 02-06-2015 7.50 / 04-03-2015 7.75 / 15-01-2015 8.00 / 28-01-2014 7.75 / 29-10-2013 7.50 / 20-09-2013 7.25 / 03-05-2013 7.50 / 19-03-2013 7.75 / 29-01-2013 8.00 / 17-04-2012 8.50 / 25-10-2011 8.25 / 16-09-2011 8.00 / 26-07-2011 7.50 / 16-06-2011 7.25 / 03-05-2011 6.75 / 17-03-2011 6.50 / 25-01-2011 6.25 / 02-11-2010 6.00 / 16-09-2010 5.75 / 27-07-2010 5.50 / 02-07-2010 5.25 / 20-04-2010 5.00 / 19-03-2010 4.75 / 21-04-2009 5.00 / 04-03-2009 5.50 / 02-01-2009 6.50 / 08-12-2008 7.50 / 03-11-2008 8.00 / 20-10-2008 9.00 / 29-07-2008 8.50 / 24-06-2008 8.00 / 11-06-2008 7.75 / 30-03-2007 7.50 / 31-01-2007 7.25 / 30-10-2006 7.00 / 25-07-2006 6.75 / 08-06-2006 6.50 / 24-01-2006 6.25 / 26-10-2005 6.00 / 31-03-2004 7.00 / 19-03-2003 7.10 / 07-03-2003 7.50 / 12-11-2002 8.00 / 28-03-2002 8.50 / 07-06-2001 8.75 / 30-04-2001 9.00 / 09-03-2001 10.00 / 06-11-2000 10.25 / 13-10-2000 13.50 / 06-09-2000 15.00 / 30-08-2000 16.00 / 09-08-2000 10.00 / 21-07-2000 9.00 / 13-07-2000 12.25 / 28-06-2000 12.60 / 27-06-2000 13.05 / 23-06-2000 13.00 / 22-06-2000 13.50 / 21-06-2000 14.00 / 20-06-2000 13.50 / 19-06-2000 10.85 / 14-06-2000 9.55 / 13-06-2000 9.25 / 12-06-2000 9.05 / 09-06-2000 9.00 / 07-06-2000 9.05 / 05-06-2000 |

Source: RBI

FAQs

What is repo rate in simple words?

Repo rate is the interest the RBI charges on banks, to lend money to them. Since October 2019, all major banks in India have linked their housing loans with the repo rate, allowing faster transmission of policy rates.

Why is repo rate higher than reverse repo rate?

The RBI cannot offer higher interest on deposits and charge lower interest on loans. This is why the repo rate, the interest it charges from banks to lend money, is higher than the reverse repo rate, the interest it pays on deposits.

Who sets repo rate in India?

Banking regulator RBI is responsible for monitoring and setting the repo rate periodically. The rates are revised bi-monthly during the RBI monetary policy review meetings.

An alumna of the Indian Institute of Mass Communication, Dhenkanal, Sunita Mishra brings over 16 years of expertise to the fields of legal matters, financial insights, and property market trends. Recognised for her ability to elucidate complex topics, her articles serve as a go-to resource for home buyers navigating intricate subjects. Through her extensive career, she has been associated with esteemed organisations like the Financial Express, Hindustan Times, Network18, All India Radio, and Business Standard.

In addition to her professional accomplishments, Sunita holds an MA degree in Sanskrit, with a specialisation in Indian Philosophy, from Delhi University. Outside of her work schedule, she likes to unwind by practising Yoga, and pursues her passion for travel.

[email protected]